Award-winning PDF software

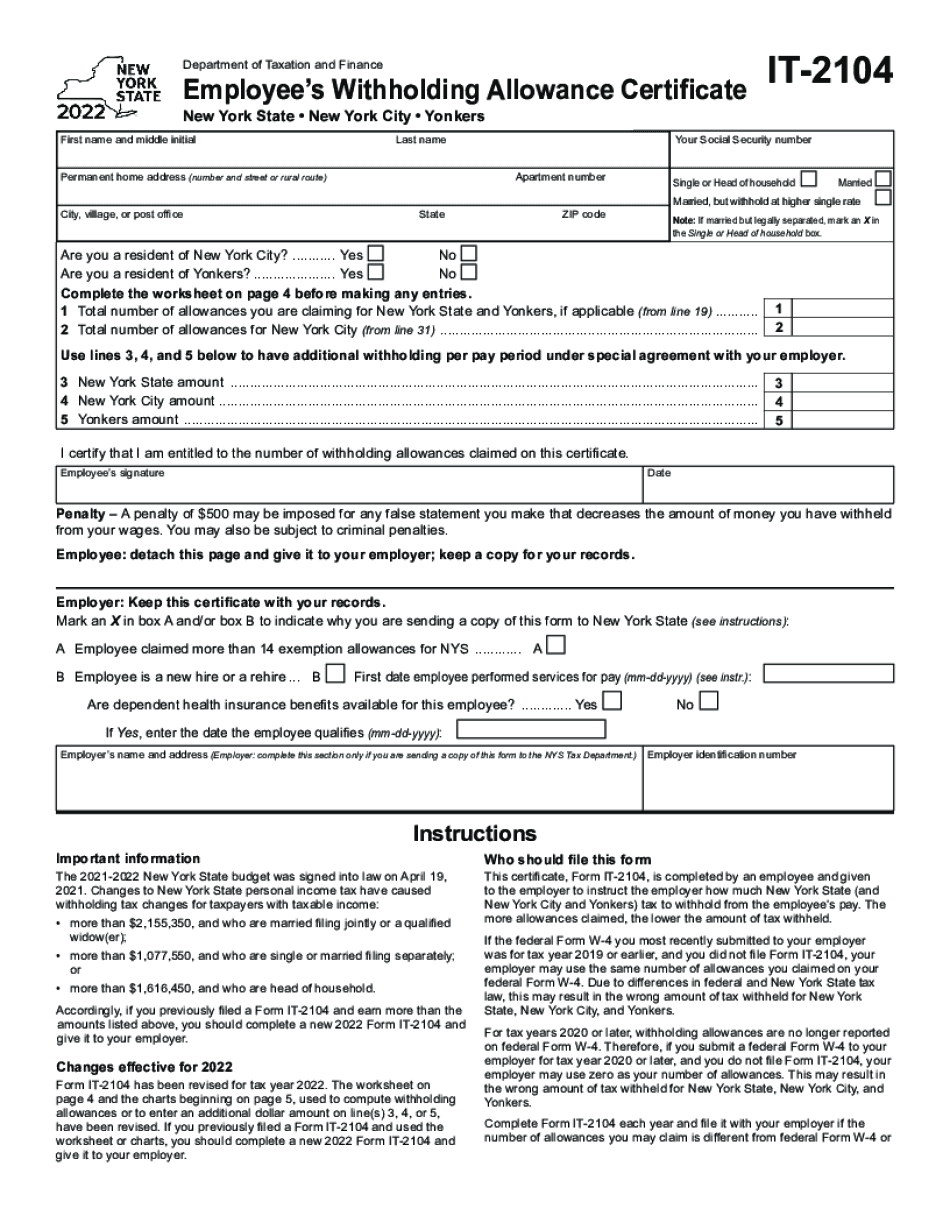

IT-2104 Form: What You Should Know

An individual may become an annuitant by (1) becoming disabled during his or her working life, (2) electing or failing to elect a full annuity instead of a lump-sum payment, or (3) being transferred in and out of or during his or her lifetime. Annuitants do not need to withhold income taxes from a payment (i.e., a payment made by a trust, a foundation, a trust company, or a bank) unless they receive a Form W-9, or by filing Form 2350, if no W-9 is available. The following income-tax withholding information may be helpful. Income from sources without a payment recipient (non-payroll) sources Amount due on your income tax statement (for 2024 and 2018) or a Form 1040 or Form 1040A or Form 1041 (if married filing jointly) You pay a balance due on your tax return (or a refund or an extension of time to pay), or a third party issues a release, as required, on your behalf, for payment on your income tax return Form IT-2104-P, An Annuitant's Request for Income Tax Withholding (Annuitants must request that Form 1310 to determine withholding) There are two ways to apply for an exemption for military service personnel. One is a “fill-in” exemption of the full value of an annuity. This is for any individual who makes a payment in any of the following situations: A recipient of an annuity receives it and gives it to another person, for whatever purpose, and the recipient then gives to the annuitant the total value, under the terms of the annuity contract, of the payment; or an annuitant decides to give an entire annuity for an income tax refund in exchange for a reduced or partial reimbursement, under terms of the payment, where one of these two factors is satisfied. The second way is a “non-fill-in” exemption of the full value. This way allows non-payroll sources to claim the full value of a portion of a military pay or annuity payment, so that the payment recipient does not have to worry about an exemption from the payment recipient's tax return. There are some restrictions to this method. An individual who receives a full payment from a non-payroll source (e.g.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form IT-2104, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form IT-2104 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form IT-2104 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form IT-2104 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.