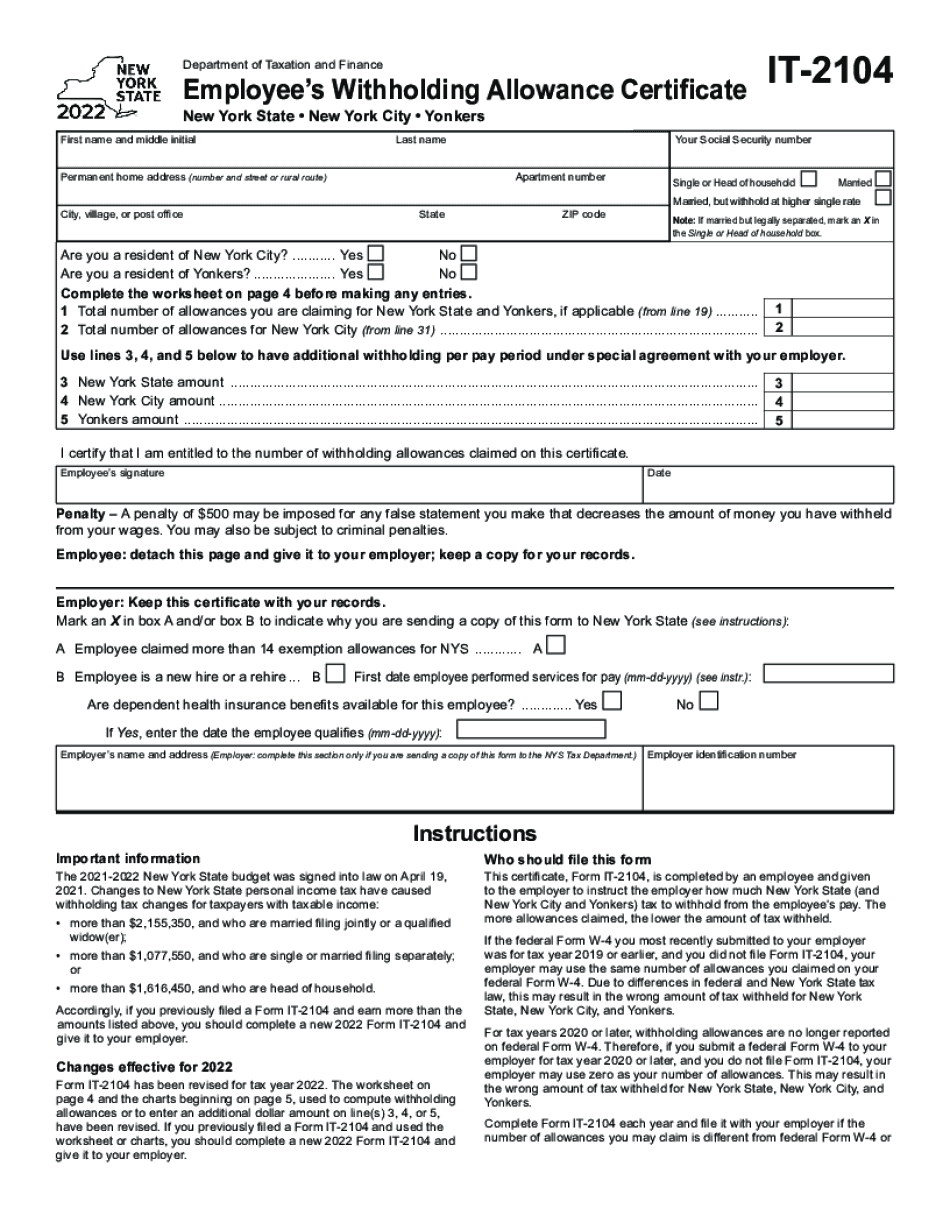

Got employees in new york brought to you by baron payroll attention new york business owners are you familiar with the mandatory new york it-21 new hire form stay tuned and find out what this form is why you didn't need to use it before and why you must use it now do you find the ever changing new york state and local regulations overwhelming would you like some help we have the information new york business owners need to know got employees in new york stay tuned and be sure to like subscribe and ring that bell so you can receive free alerts every time a critical new york employment law changes hi i'm bill elkins with baron payroll in 2024 the irs drastically changed the w-4 form every employer gives new employees a w-4 form so they can withhold the proper amount of federal income tax from the employees pay however the information required on the new w-4 no longer contains the data needed to withhold the correct new york state tax from your employee's paycheck how can you fix this issue easy give new employees two forms now a w-4 for federal withholding and the 2104 for new york state withholding this is what a 2104 form looks like are you familiar with this form are you using this form now in your organization if not you should start using it immediately click the link below to download the 2104 form and see how to fill it out thanks for watching be sure to like and subscribe so you can stay in the know and keep your business safe and running smoothly.

PDF editing your way

Complete or edit your it2014 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export it 2104 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your 2021 form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 2021 nys form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form IT-2104

About Form IT-2104

Form IT-2104 is a tax withholding form used in the state of New York for individuals to specify their tax withholding preferences. It is required for employees who are subject to New York State and/or New York City income taxes. This form is used to determine the amount of income tax that should be withheld from an individual's paycheck by their employer. It requires individuals to provide information about their filing status, dependents, and any additional withholdings, deductions, or exemptions they may qualify for. The completed form helps employers accurately calculate the appropriate amount of income tax to withhold and remit to the state and city tax authorities on behalf of the employee.

What Is IT-2104 Form?

IT-2104 form or Employee’s Withholding Allowance Certificate is a document used by employees to specify the amount of payment an individual should withhold.

It is common in New York State and is approved by the local Department of Taxation and Finance.

The main importance of this form is in the possibility for employees to claim the right to lower the amount of tax due.

It should be filed together with W-4 form once per year. In other case, it may be filled out if you meet the following positions:

- You got a new job

- You recently moved to New York State

- You transfer the deductions to your personal income tax return,

- You want to obtain allowance for New York credits.

To fill out the IT-2104 pay attention to the required details below:

-

Your personal data

-

Address

-

SSN

-

Your marital status

-

Confirmation that you are a resident of New York City.

-

List of allowances you want to obtain.

There is also a space for details provided by the employer.

The document has an additional worksheet and instruction to count the withholding allowances and deductions correctly.

Once the blank form is completed, it is necessary to put the current date and sign the document. It is also possible to print the fillable form to have it on hand.

Thereafter, send it to the employer.

Online options help you to prepare your document administration and increase the efficiency of one's workflow. Follow the short handbook as a way to entire Form IT-2104, refrain from errors and furnish it in a very well timed manner:

How to finish a Form IT-2104 on the internet:

- On the website aided by the kind, simply click Start Now and pass towards editor.

- Use the clues to fill out the relevant fields.

- Include your own material and speak to details.

- Make certainly that you simply enter correct knowledge and quantities in applicable fields.

- Carefully take a look at the subject matter of the variety in the process as grammar and spelling.

- Refer to support section in case you have any issues or address our Guidance crew.

- Put an electronic signature on your own Form IT-2104 using the assist of Sign Device.

- Once the form is accomplished, push Performed.

- Distribute the prepared type by means of electronic mail or fax, print it out or preserve on the gadget.

PDF editor will allow you to definitely make adjustments for your Form IT-2104 from any world-wide-web linked machine, customize it in line with your preferences, signal it electronically and distribute in various techniques.

What people say about us

Gain access to professional filing opportunities

Video instructions and help with filling out and completing Form IT-2104