Right, hey! How are you doing? This is Malling, here to introduce you to this video. We're going to discuss how you can receive an $800 tax refund each month. Before we begin, I want to clarify that I am not a tax professional. I will simply inform you about what you have access to. If you want to verify the information, consult a tax professional. Now, keep in mind that the $800 refund may vary. It depends on your income and tax bracket. I will share some insights with you that many people are unaware of. This refund allows you to retrieve money from your paycheck that you are missing out on. So, make sure you take action after watching this video by contacting the person who shared this information with you. It's not me, but someone mentioned in the video. Click on the button below for a chance to schedule a free 30-minute coaching session with me. During this session, I will guide you on how to set everything up and stop losing so much money. Now, let's talk about taxes. Everyone is required to spend money on taxes, regardless of what they buy. One of the highest tax bills is associated with our paychecks. We all know that the money we make is reduced by the taxes that are taken out. However, today I will reveal how you can retain more of your hard-earned money. We will refer to it as a monthly tax refund. Have you heard about the Form W-4? When you started your job, most likely, nobody really explained this form to you. Only a small percentage of individuals truly understand its purpose. Now, let's focus on pages A through G. Ask yourself, does this apply to me? Determine your total allowances or extensions...

Award-winning PDF software

Nyc paycheck tax calculator Form: What You Should Know

New York Hourly Paycheck Calculator — PaycheckCity This New York hourly pay calculator is perfect for those who are paid on an hourly basis. Switch to New York hourly paycheck calculator. State & Date. New York Tax Calculator — OPA Income tax information is provided by the New York State Department of Division of Taxation and Finance. Use the tax calculator instead of New York income tax calculator. State & Date. New York Income Tax Calculator — OPA Income tax information is provided by the New York State Department of Division of Taxation and Finance. Use the tax calculator instead of New York income tax calculator. State & Date. New York Income Tax Calculator — OPA Income tax information is provided by the New York State Department of Division of Taxation and Finance. Use the tax calculator instead of New York income tax calculator. State & Date. Monthly Income Tax Breakdown — OPA The New York Department of Taxation & Finance (ODT) provides monthly income tax breakdowns for a range of tax categories. Tax Brackets: 1. Single — 35.00 2. Couple — 45.00 3. Married — 55.00 4. Head of Household with Child — 47.50 Tax Rates: Filing Status: Single Currency: United States Dollar () Year End: December 31, December 31, 2024 (except January 31) New York Monthly Income Tax Breakdown — OPA The New York Department of Taxation & Finance (ODT) provides monthly income tax breakdowns for a range of tax categories. Tax Brackets: 1. Single — 100.00 2. Couple — 140.00 3. Married — 210.00 4. Head of Household with Child — 180.00 Tax Rate: -1% (income tax not paid on interest, dividends or capital gains) Filing Status: Single Currency: United States Dollar () Year End: December 31, December 31, 2024 (except January 31) New York Monthly Income Tax Breakdown — OPA The New York Department of Taxation & Finance (ODT) provides monthly income tax breakdowns for a range of tax categories. No.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form IT-2104, steer clear of blunders along with furnish it in a timely manner:

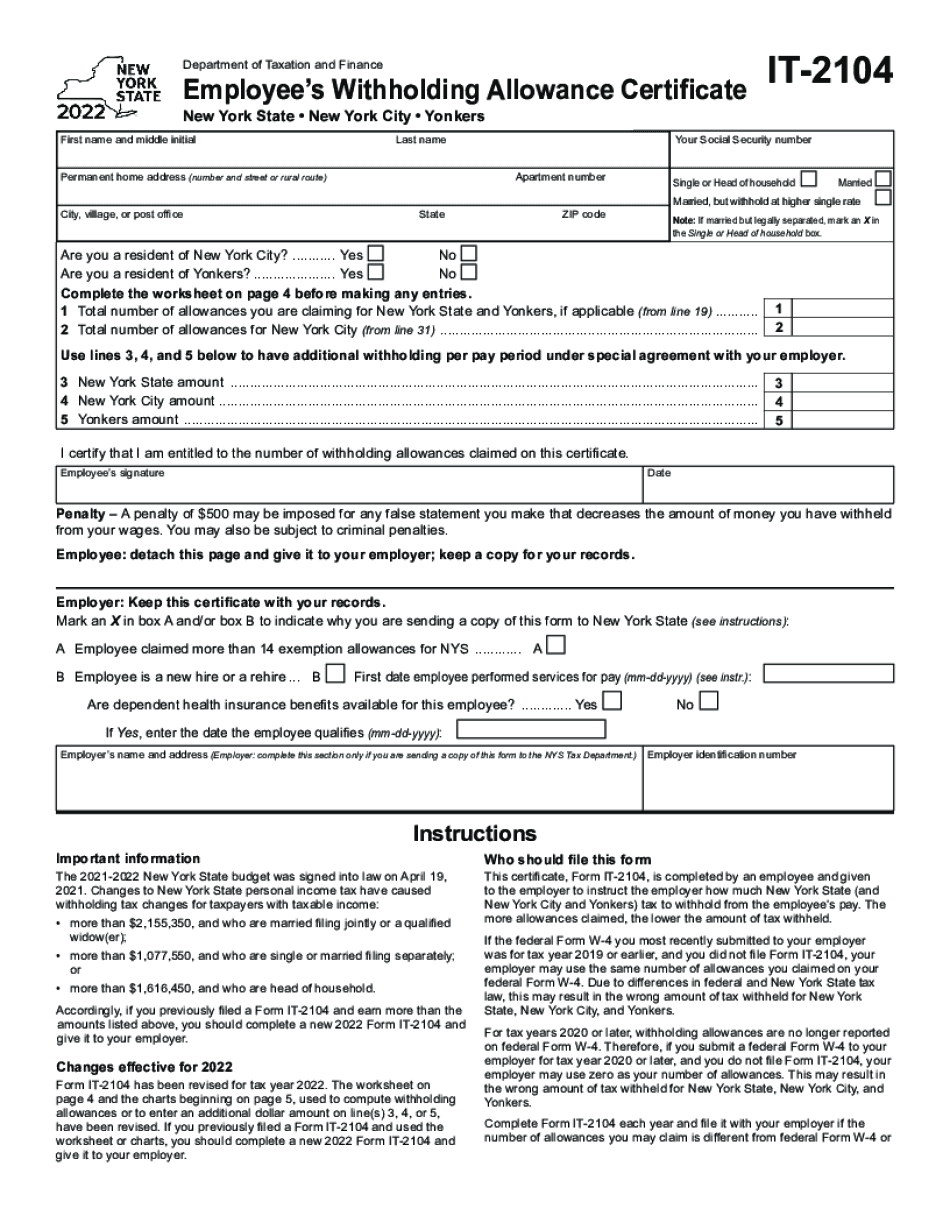

How to complete any Form IT-2104 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form IT-2104 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form IT-2104 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Nyc paycheck tax calculator