New York State offers generous tax credits for working families with low to moderate income even if you don't owe taxes you can still claim these credits and receive a refund this puts more money in your pocket and helps you and your family make ends meet don't pass up the opportunity to claim these valuable credits for instance if you earn a modest income and have children you probably qualify for the New York State Earned Income Credit this tax credit provides a cash benefit for families who work hard but don't have much money left over to pay household expenses to claim this credit you must qualify for and have claimed the federal Earned Income Credit on your federal return if you pay someone to care for your child or a member of your household you may be entitled to the New York State child and dependent Care Credit this tax credit provides a cash benefit for those who pay a care provider so they can work or look for work to claim this credit you only need to qualify for the federal child and dependent Care Credit if you have any children at least four years old you probably qualify for the Empire State child credit this tax credit provides a cash benefit for parents to help with the cost of raising a child in New York State if you live in New York City you may also qualify for additional benefits such as the New York City Earned Income Credit the New York City child and dependent Care Credit or the New York City school tax credit remember you can still claim these credits even if it's past the filing deadline you have three years from the due date to claim these credits if you need...

Award-winning PDF software

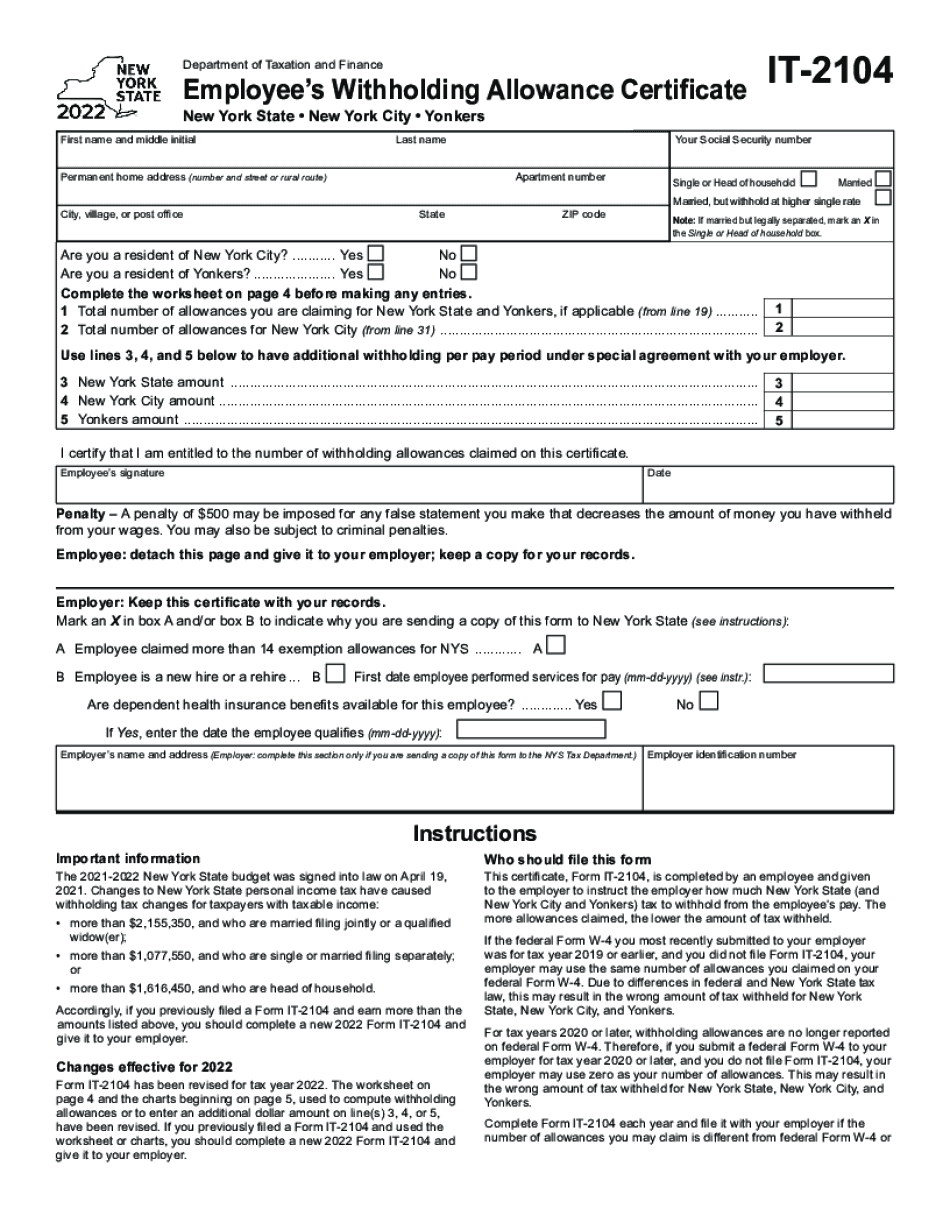

New york state withholding allowances Form: What You Should Know

Complete “I certify that I have completed the form. “ 2 Note that only the table on page 5 is required for NY State tax on New York State (and, NYC) New York State Tax with NY City. Form IT-2104: 2018: employee's withholding allowances for New York State and Yonkers, if applicable. The withholding allowances are given a New York State withholding allowance. (Note: NY State and NY City resident withholding will not be given the same amount since the tables are different) Form RMS-1: 2018: New York City Resident Payroll Expensing Tax Return Payment Method: Wage Subsidy Pay See: Form RMS-1, New York City Resident Payroll Expensing Tax Return for 2018. Form IT-2104: Employee's Withholding Allowance Certificate for NY State and Yonkers, if applicable. Form IT-2104: 2014: Federal Unemployment Tax Return. Tax Return Withholding Allowance Certificate for NY State and Yonkers This form is completed by an employee and given to the employer to instruct the employer when to withhold taxes from the pay of the employee. Form IT-2104: 2018:Employee's Withholding Allowance Certificate Form NYS Employer's (NYSE) Wage and Tax Statement (WAS) The federal and state unemployment taxes are to be given with the WAS statement. Form IT-2104: 2014: Federal Unemployment Tax Return. Eligibility for the WAS Statement: Must: Have paid federal and/or New York State unemployment taxes and have had wages subject to the minimum wage requirements of NYS. Note: If you need a WAS from your employer, see: Forms WAS: 2014–2015. Form IT-2104: 2014: New York City Resident Income Tax Return. Wages subject to minimum wage requirements of NYS and the federal unemployment tax are to be given with the income tax form. Form IT-2104: 2014: Federal Tax Withholding Statement and 2024 State Withholding Statement An employee's WAS must specify the wage and tax withheld from the amount of federal and State taxes withheld. For New York City residents: the Form IT-2104 is completed by the employee, given to the employer, and mailed to the Department of Taxation and Finance.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form IT-2104, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form IT-2104 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form IT-2104 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form IT-2104 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing New york state withholding allowances