Award-winning PDF software

It-2104 how to fill out Form: What You Should Know

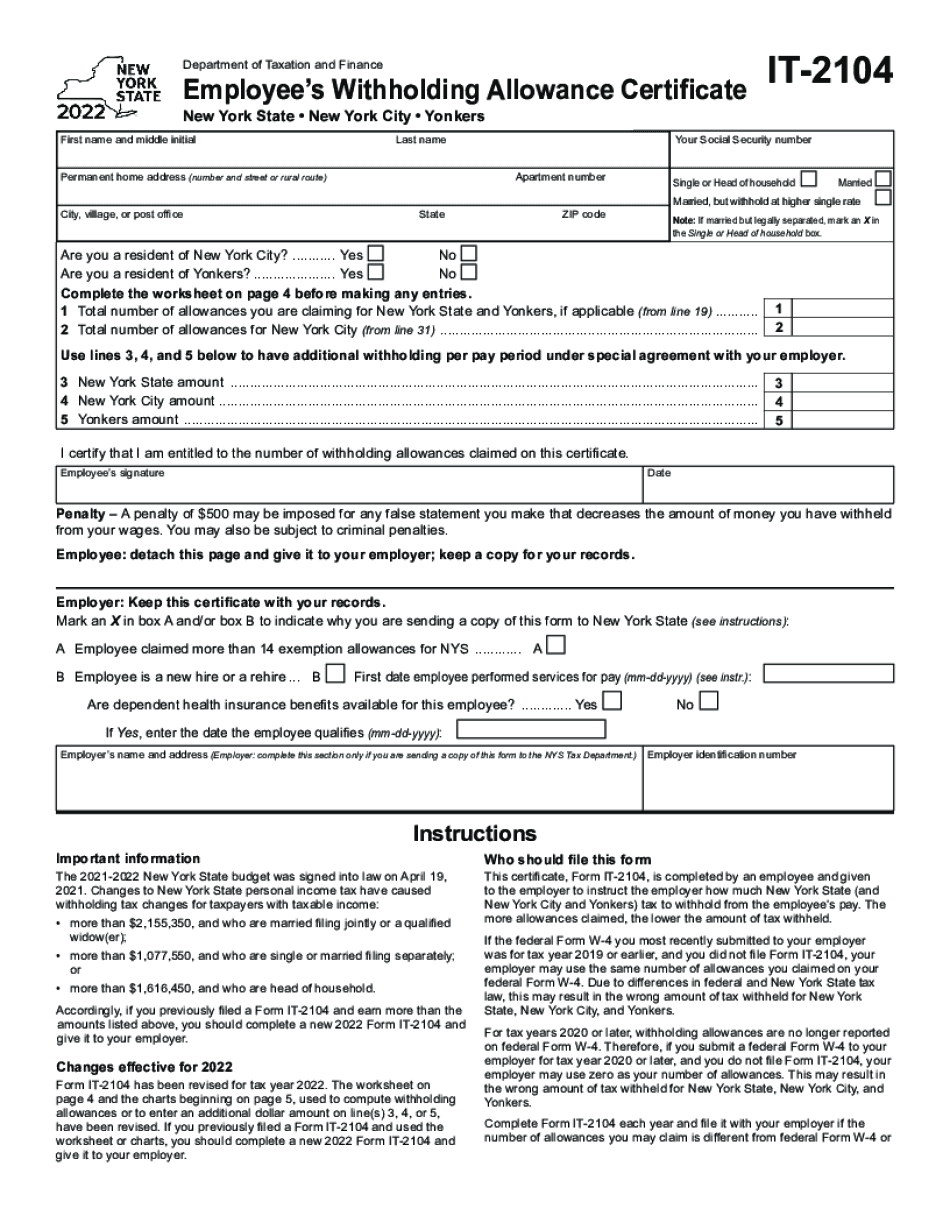

New York State with Federal Income Taxes, or your pay is based on the federal income tax withholding amount for New York State. When you fill out a NY State tax withholding form it isn't the end of the world for you. However, the NY State Department of Taxation has the ability to collect income tax if you fail to pay in full each month. You probably know by now that this year is going to be a doozy! The amount of money you're likely to hit with New York State taxes on April 15, 2017, will be far more than you expected! Let's take a look at how New York State taxes will start to come into play when you file your taxes for the year! For those of you that have federal income taxes withheld at work, there is going to be much less work to do to prepare and file your taxes for April 2017. However, you need to continue with the work you started on when you filed your federal year. The easiest place to begin working on the federal taxes is with the New York State tax forms. First off, you need to complete your April IT-2104 form. This is a one time information gathering process that you fill out to obtain a Certificate of Eligibility to be an Individual Making Qualifying Contributions to the State Education Fund. It is the first step in the IRS process allowing you to have your tax returns for a given year made electronically available as a public record. Next, make a new NY State tax withholding form. This is when you begin waiting until you receive your annual report from the IRS from April onwards in order to see if your state income tax payments will be withheld and paid. The New York State Tax Department will begin collecting all or part of the State income taxes withheld as of April 15, 2017, and send you a notice that your amounts of Social Security and Medicare tax, as well as federal unemployment insurance and income taxes, will be automatically withheld from your pay for April. You can then use the income tax withholding form to check how much of the payments you have left for the following month. I'm sure you can see why I think this is the most important aspect of preparing and filing a NY State New-Y I want to be prepared for my April filing! What to Consider when Filing a NY State New-Y Individual After filing your taxes, don't forget to keep filing.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form IT-2104, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form IT-2104 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form IT-2104 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form IT-2104 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.