Welcome to the 1099 ET c program. This tutorial covers efiling Part C of the NY is 45 form in an MSP role. Once the file is created, you will then upload it to New York following their instructions. You will also be responsible for filing Parts A, B, and D on your own prior to submitting the e-file. Beforehand, you must create an online services account and submit a test file to New York. For more information on this process, please review the following publication: 911 publication and Why is 50 the mag media section on New York's website? We are now ready to create the file. To begin, the pair ABC payroll has been created, and the payer's data has been entered and verified. In an MSP role, select forms, then select see print state court early return. Select "For print using software-generated forms" and click next. Select the quarter and check for file Part C electronically. Click OK. Enter and/or edit the general information. Click OK. Enter and/or edit the signer information. Click OK to print the form and verify that the NY is 45 data is correct. If the data is correct on the NY is 45 form, click quit and finish posting deposits and printing the client letters. Now, to create the file for Part C of the NY is 45 form, select options, then select magnetic media filer. Select NY is 45 Part C and click OK. This screen is used to designate the location where the file will be saved. We recommend the default location, which is the program directory. Click OK. Select the quarter. In most cases, since you have already printed the form, the preparer's information will already exist. If it does not, click prepare and enter the information. Otherwise, click OK. The...

Award-winning PDF software

Nys-45 2024 Form: What You Should Know

Note: Form IT-2104-SNY will become effective for reporting wages on Jan 5, 2021. Jan 2024 — IT-2104-SNY (Fill-in), Instructions on form, Certificate of Exemption from Withholding for START-UP NY Program, NYS-45E, New York State Unemployment Insurance: Employment Information Reporting Guide Jan 2024 — IT-2104-SNY (Fill-in) (2023), NYS-45E (2023), NYS-46, Unemployment Insurance Forms and Instructions: Forms and Instructions, NYS-45E, NYS-44, Forms and Instructions for Reporting and Payable NYS, NYS-50, NYS-54, and NYS-60 Jan 2024 — NYS-46, Forms and Instructions for Reporting and Payable NYS, NYS-46E, NYS-44, Forms and Instructions for Reporting and Payable NYS, NYS-49, NYS-55, NYS-61, and NYS-62 Jan 31, 2024 (Feb 1–Jan 8–June 15–Jan 26, 2023) — NYS-60, Forms and Instructions for Reporting and Payable NYS, NYC Unemployment Insurance: Exemption from Withholding for Job Search/Job Seekers Program (2023), NYS-46E, NYS-44, Forms and Instructions for Reporting and Payable NYS, NYS-45-SE, NYS-52, NYS-54, and NYS-65 For questions please go to the following location. NYC Employment Law and Enforcement Section: The Form NYS-45-X is available online at . You can also find it on the NYS-45 Employer, You may fill out our online application for the New York State Unemployment Insurance (NYS/NYS-45) Employer Reporting Program. Please note that there is some flexibility with a few employers whose business is the sole source of their payroll. New York State Unemployment Insurance: Employment Information Reporting Guide (2022), NYS.

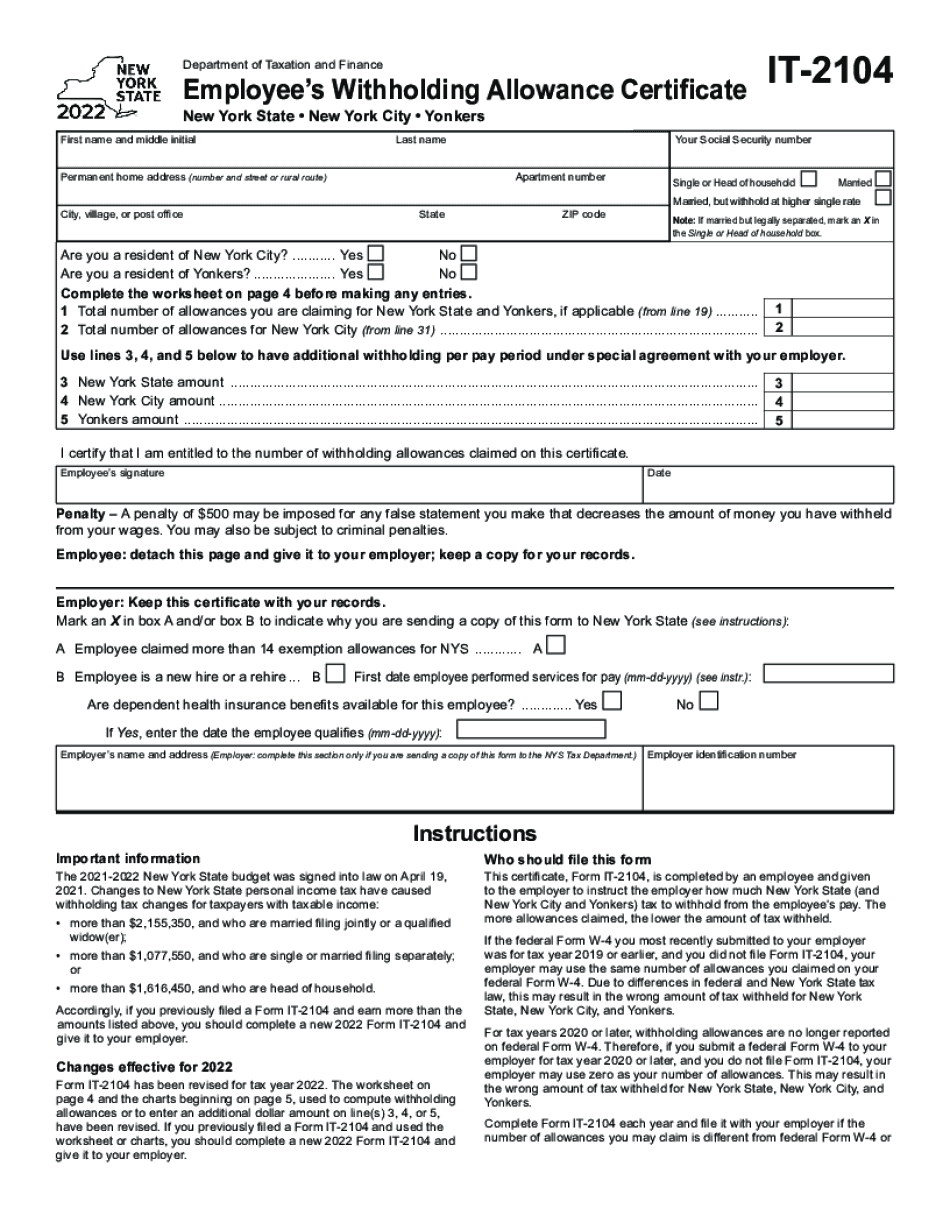

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form IT-2104, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form IT-2104 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form IT-2104 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form IT-2104 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Nys-45 2024