Award-winning PDF software

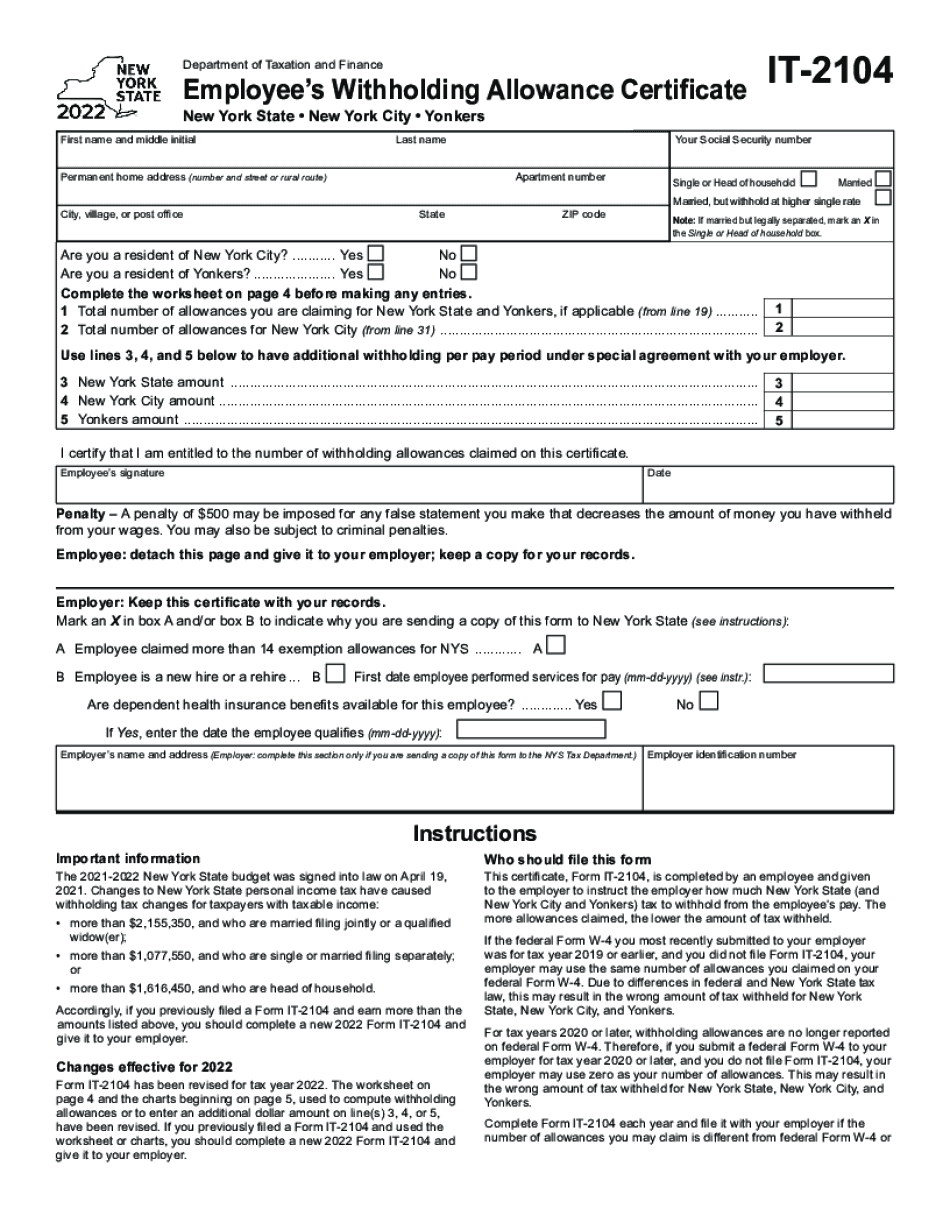

It-2104 new york state withholding allowance certificate

If you have any questions about this Notice and the IRS Form 2104, you may call our toll-free Helpline at. EIN: 46-251840 W-2G Form W-2G for Nonprofits (Employee Self-Employed Account) (The IRS Form W-2G is used to determine the amount of your employment and payroll taxes for employees for the current year unless you provide a statement certifying or otherwise proving that your organization, its employees, or its organization's employees are exempt from federal income tax. See Rev. Pro. 2015-15, 2015-13 856.) Form W-2G is used to determine the amount of your income, the amount of your payroll taxes, and the amount of your wages. You must complete the information for your state and mayor's state withholding allowance for state income tax. See Rev. Pro. 2015-15, 2015-13 856. If you are not an institution or organization described in Rev. Pro. 2015-15, you may provide the Form W-2G to your employees as a reminder to.

New york it-2104: to file, or not to file?

New Yorkers shouldn't put off the choice for the sake of “business confidentiality” or “operational convenience”. It's a major decision and employers should have the expertise to make it well. June 28, 2019 — One of the biggest questions I get asked is about the importance or the importance of having a job safety plan. The fact is in most employment law jurisdictions, the mere fact that a company or organization has a job safety plan is not enough to meet the requirements of the OSHA Safety Rules. September 20, 2019 — The California Department of Industrial Relations has a new rule that could drastically change the way businesses and organizations approach employee safety. The new law (AB 2109) requires employers to include information about how they are protecting employees in their safety and health programs. August 3, 2020 — The Oregon Health Authority (OHA) released their annual report , which includes.

Form it-2104 (pdf)

If you are a covered employee, you have to meet the tax year 2018 threshold for the new Additional Allowances. Note Tax year 2018 also referred to in Table IT-2104. How do I increase my taxable salary? Employers can increase taxable salary up to a limit of 90,000 as per the following table. This amount can be withdrawn from an employee's salary deductions to use as per the Table IT-2120. How can I make a deduction for salary paid to our employees? Employees can carry forward a deduction for salary from which they can deduct an amount of up to 90,000 in the tax year 2018, Additional allowances are not allowed on salary paid. If you are a covered employee, you must meet the tax year 2018 threshold for the new Additional Allowances. Deductions from salary deducted from remuneration (salary + allowances): Amounts paid by employers for salary/pay may be deducted from the remuneration payable to.

It-2104 instructions - student employment

Can determine the correct amount of withholding. Click here to download Form IT-2104 (PDF). To file Form IT-2104, complete the entire form and return it to the Office of Workers' Compensation Appeals by 10 July 15, 2016. The above information was published in the April 2016 issue of the Tax Foundation's Tax Bulletin, which provides the latest tax advice for state and local governments, small businesses, and taxpayers. For questions or comments regarding this tax bulletin, click here. For a list of all Tax Foundation publications, click here .

State agencies bulletin no. p-948

Note: Please print out and complete the Form IT-2104-E as required. In order to submit the Form IT-2104-E, you will need to: Complete the Form IT-2104-E to show an employer has received the Form ITA. Complete an Approved Employee Form (Form IT-2104-E) to show that you have received a pay statement from your employer, and it has information needed to calculate your income tax liability. Fill out a tax return (Form IT-2318) to show that you filed a tax return to the tax year to which you are making adjustments on your employment income. If you are filing Form IT-2318 with the State of New York, attach a copy of your employer's pay statement (Form 2103) that shows the income you earned from employment which you adjusted in order to calculate the amount of Federal unemployment tax you will pay. If you are filing Form IT-2318 based on tax time, attach a copy of the Form 2103 that you were required.